Trade Tariffs: Japan and the U.S.’s Contrasting Approaches

Balancing protectionism and free trade

As global trade tensions rise, there is increasing debate about trade tariffs. Opinions can be polarized. Some believe that tariffs—a tax imposed on foreign-made goods, paid by the importer to its home country’s government—are great for boosting domestic manufacturing. Others argue that they may hurt industries and national interests. While some countries, like the U.S., have adopted protectionist policies, countries like Japan have taken a more non-protectionist approach.

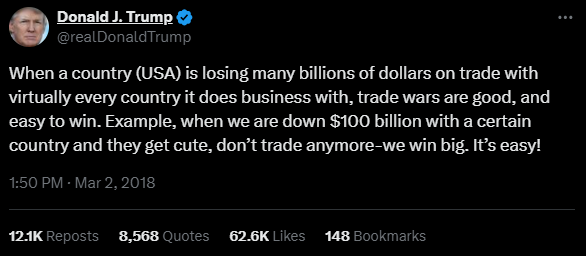

Protectionist U.S: The Trump Era

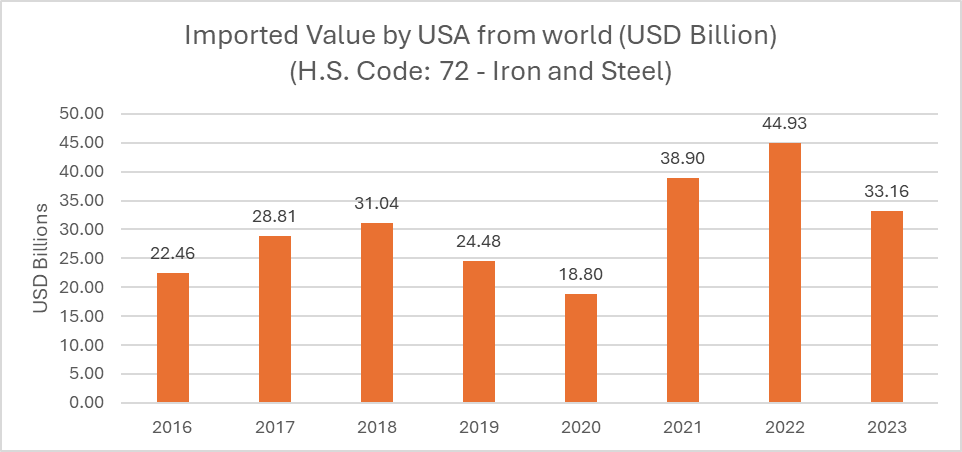

In 2018, The Trump administration made headlines when they announced that the US would impose a 25% tariff on steel imports and 10% tariff on aluminum.

The White House’s stance was that increasing imports of aluminum and steel were pressurizing the domestic industry, the job market, and even imposing a threat on national security. A NPR article at the time reported that White House trade adviser Peter Navarro talked about how “Steel and aluminum are bedrock, backbone industries of this country, and the president is going to defend them against what is basically a flood of imports that have pushed out American workers, aluminum smelters.”

However, the repercussions were far wider than that. Steel imports did dip initially, but domestic manufacturers soon felt the pinch of rising production costs. Meanwhile, countries like Canada negotiated exemptions, and finally, in 2021, the tariffs were removed by the Biden administration.

The impact didn’t stop there. Retaliatory actions by several affected countries hit U.S. goods, particularly food products, leading to estimated losses of around $13.2 billion from mid-2018 through 2019. Japan, a notable steel exporter, took a cautious approach, aligning its actions with the rules of the World Trade Organization (WTO). In a Reuters article, a government official said, “We wouldn't stand idly by, but ... if we did the same thing as the United States by taking steps that are against WTO rules, that would be like a children's spat.”

Japan’s Non-Protective Approach: A Winning Strategy for… Cars?

apan has promoted a free trade policy with relatively low tariffs on imports across several sectors. Its average tariff rate for all items is among the lowest in the world at 4.6%. Japan participates in multilateral trade agreements, gaining access to vital resources. Given the country's lack of several natural resources, it imports raw materials and uses them to manufacture products for export.

Take the automotive sector, for instance—an industry that makes up 17.4% of Japan's manufacturing landscape. Tariffs for major automotive parts have been tariff-free since 1978, a stark contrast to the U.S., where trucks face an excessive 25% tariff.

This policy has helped companies like Nissan and Toyota thrive, enabling them to build innovative electric vehicles (EVs) and hybrid cars at competitive production costs. With access to battery materials and advanced components like semiconductors, Toyota has been able to scale production and invest in R&D, leading to breakthroughs such as hydrogen fuel cell technology.

Who Pays for the Tariffs?

Trump has claimed that tariffs are “not going to be a cost to you, it’s going to be a cost to another country”. Contrary to this, research has consistently shown that the costs are often borne by domestic consumers and importers.

As the U.S. election approaches, the potential for a Trump victory could reignite discussions about raising tariffs, prompting economists and businesses to keep a close eye on the implications. Meanwhile, Japan seems poised to maintain its non- protectionist stance, favoring low tariffs and international cooperation.

Selected Sources

https://www.mofa.go.jp/region/asia-paci/australia/study0504/chapter4-2.pdf

https://www.jama.or.jp/statistics/facts/tariff/index.html

https://www.geneve-mission.emb-japan.go.jp/itpr_en/statement_trade_20230301.html

https://global.toyota/en/newsroom/toyota/38482540.html

https://www.jama.or.jp/english/reports/docs/MIoJ2024_e.pdf